Business tax seems to be inequitable

Published 5:14 am Wednesday, June 27, 2018

The letter from the Wallowa County Assessor’s office was brief, but nonetheless annoying. The portion that “got my Irish up” read as follows:

“Thank you for sending in your 2018 business personal property return. Your inventory appears to be incomplete; per ORS 308.285 you must provide our office with a complete list of everything contained in your business.”

Trending

“Yikes!” I said aloud when I read the notice (or something to the same effect.) “Do they want an itemized list of pencils, spoons and pillow cases?”

I have been filling out the two-page business personal property tax return for decades, relating first to my home construction business and then to our bed and breakfast. But previously I had always just lumped things together in general categories like “tools,” “furniture,” “appliances” or “office supplies.”

So this request for an itemized list struck me as unnecessary, intrusive, unfair and downright stupid.

So I called the assessor’s office to vent my feelings on the matter, and I left a few choice words on their answering machine. And although I was prepared to do verbal battle when my call was returned, Tyra Witherup was so darn friendly, polite, diplomatic and professional that she was hard to stay mad at.

Tyra patiently answered my questions about what items a bed and breakfast needed to list and how their value could be determined. So after considerable head-scratching and guesstimating, I came up with a two-page inventory.

But even after Tyra’s courteous explanation and my honest efforts to hunt for a set of black cats in a dark house, I still don’t see any sense at all in this particular tax.

Trending

The whole thing got under my skin so much that I have told our county commissioners my views on the subject at two meetings, and I’ll share them here with you.

Aside from the sheer difficulty of itemizing or trying to place a value on a bunch of belongings –– most of which were either passed along to us, purchased at yard sales or bought at discount prices over a decade ago –– the unfairness of the tax bothers me most.

I would like to know:

• Why tax anyone on their personal belongings? I understand that your house or land or physical business property is subject to property taxation, but why should your personal belongings be? You own them, and you have already paid for them. They are not “real property,” as defined by law.

• If you really think it is fair to tax those items, why pick on business owners? Why not everyone? Why should someone’s luxury car not be subject to this tax, while our linens and dishes are? Why would you want to discourage or penalize business owners just because these items might be helping them in some small way to earn money? After all, the income earned is already taxed.

• Why tax some business owners and not others? Why, for instance, does the law go after homebuilders but not loggers? Why are most small business owners expected to provide an inventory, but farmers and ranchers are specifically exempt?

• Why go after some forms of business personal property and not others? Why am I expected to place a value on our utility trailers and lawnmowers while much more expensive tractors and combines on farms go untaxed? Why does a builder have to list his backhoe while a rancher does not?

The whole thing began to bug me even more as the county commissioners weighed their decision on whether to increase the lodging tax to help pay for upgrades in the county fairgrounds.

Lodging guests are already uniquely burdened by being asked to pay a 9.8 percent tax in Joseph and Enterprise, and they might have to pay that same overall rate throughout the unincorporated parts of the county if a new increase is approved. That makes this whole business personal property tax seem all the more inequitable.

Maybe there are good answers to my questions, but I haven’t heard any yet. I still think this business personal property tax should be eliminated.

But it’s particularly unfair to tax some businesses while exempting others and downright silly to worry about the cost of a few nightstands while ignoring the value of brand new pickup trucks.

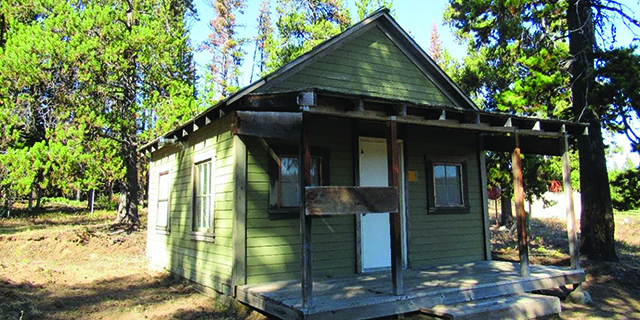

John McColgan and his wife Pepper own Belle Pepper’s Bed & Breakfast in Joseph.