HOLD Study: State subsidizes Eastern, Southern Oregon

Published 7:00 am Wednesday, February 15, 2023

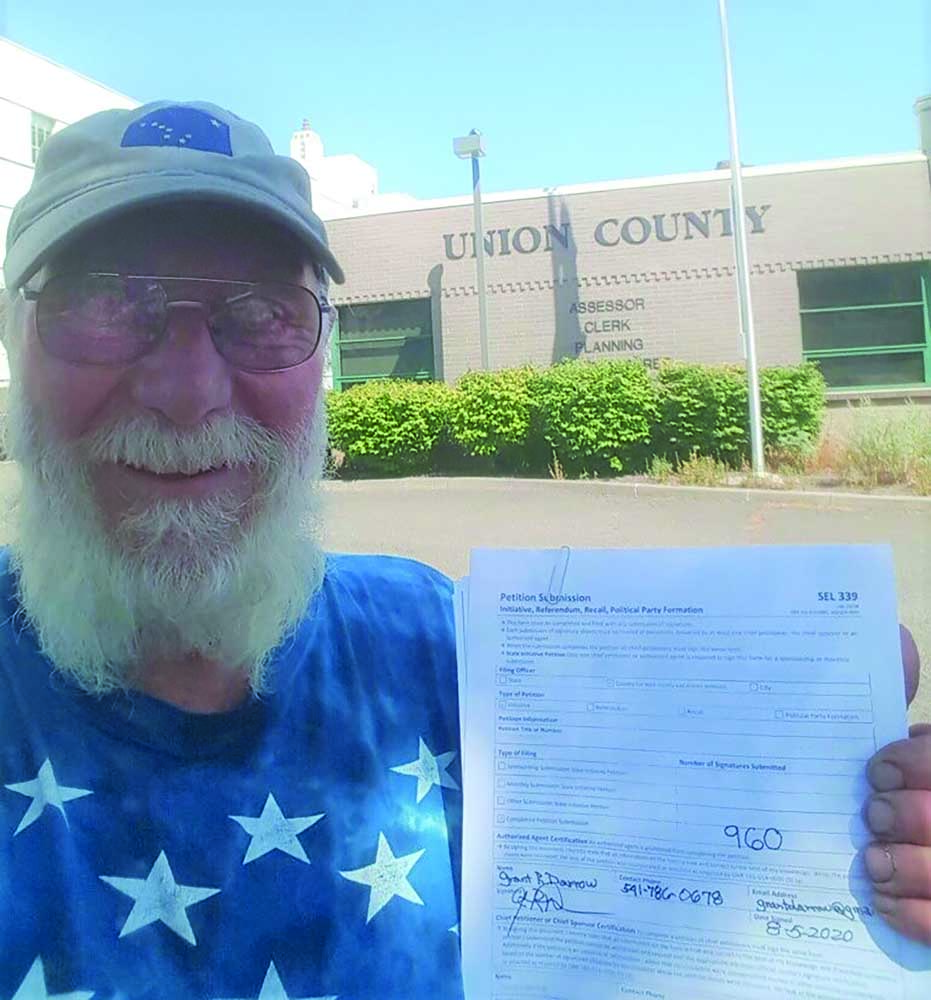

- Grant Darrow submits 960 signatures to put Greater Idaho on the May 2021 ballot in Union County.

An analysis of the economics of the Greater Idaho proposal to move portions of Oregon into Idaho finds that although Oregon’s spending per resident in Northwestern Oregon is comparable to its spending per resident in the rest of the state, high-income areas around Portland end up carrying almost all of the state’s tax burden.

The study, published Thursday, Feb. 9 by the Claremont Institute, attributes this to Oregon’s choice of a progressive income tax to fund the bulk of its government. The Claremont Institute study can be found at: https://points-consulting.com/economic-impact-of-moving-the-oregon-idaho-state-border. (It also is included in the online version of this story, posted at wallowa.com.)

The Claremont Institute is a conservative think tank based in Upland, California.

The study found that Eastern and Southern Oregon are a drain on Oregon’s state budget, but would be a benefit to Idaho’s state budget. This is because residents of Eastern and Southern Oregon have almost exactly the same per-person personal income as Idahoans, but the income of Northwestern Oregonians is much higher, according to recent U.S. government Bureau of Economic Analysis figures.

The Idaho Legislature has heard a pitch on the proposal, but a similar proposal before the Oregon Legislature is still waiting for a hearing.

“We are asking Oregon Senate President Rob Wagner to give this proposal a hearing,” said Matt McCaw, the movement’s spokesman. “It’s a win-win for both states, and a poll a year ago showed that 68% of Northwestern Oregonian voters want it to have a hearing.”

The 99-page report predicts that, under Idaho’s lower taxes and regulation, the economy of Eastern and Southern Oregon would surge, providing a benefit to Idaho’s state budget. The benefit to Idaho’s budget of adding Eastern and Southern Oregon would be $170 million annually, according to the study, assuming Idaho leaves Oregon’s weight-mile tax on road freight in place in that area (Idaho does not have such a tax).

The average resident in Northwestern Oregon sends $360 in taxes to subsidize Southern and Eastern Oregon every year, according to the same study, or $690 per wage-earner.

The study, which began in 2021, analyzed the impact of adding both Eastern and Southern Oregon to Idaho, although the Greater Idaho movement in May revised its proposal to not include Southwestern Oregon until public opinion there embraces the idea.

The Greater Idaho movement welcomed the study but pointed out that, although the study demonstrated reasons that Eastern and Southern Oregon’s gross domestic product would grow by 2.1% due to a border relocation, the study acknowledged that the actual growth could be higher.

“Lastly, it is important to note that there are any number of economic possibilities that could result from the border relocation,” the study stated. “Our effort with this analysis is to tabulate those which we can quantify and defend.”

The study cited several economic benefits to Eastern and Southern Oregon of joining Idaho, such as lower taxes, lower unemployment and a lower cost of living.

The movement’s statement responded to the study’s comments on debt by pointing out that Oregon’s state government has much more assets than debt, according to a tabulation by Truth in Accounting/University of Denver. In fact, the net assets of Oregon’s state government per resident are almost exactly equal to those of Idaho. Therefore, if Eastern Oregonians brought their share of their state government’s assets and debts into Idaho, they would hardly change Idaho’s per-person net assets.

The Claremont study did not guess at what Idaho would agree to pay for eastern Oregon because it would be entirely negotiable, and it would depend on which Oregon state assets and debts Idaho and Oregon agreed to transfer to Idaho. Less than 3% of Eastern Oregon is state land; it is mostly federal or private land.

The analysis was performed by Points Consulting, an economic analysis firm based in Moscow, Idaho, that has completed more than 100 economic analyses over the past decade.